Budgeting & Cashflow

When it comes to budgeting and the cash flow structure, there is no single ‘one size fits all’ approach. Everyone is different when it comes to income and spending habits. Therefore, your budgeting strategy must work for you.

What should I consider when budgeting?

Important considerations when it comes to budgeting and cashflow include:

➔ Do I have a good understanding of my current expenses and saving potential?

➔ Does my current bank account structure make it easy to track my spending habits?

➔ Am I directing my surplus cash towards my goals regularly?

➔ Could I be doing more with the money I’m saving?

How can Inovayt help me budget?

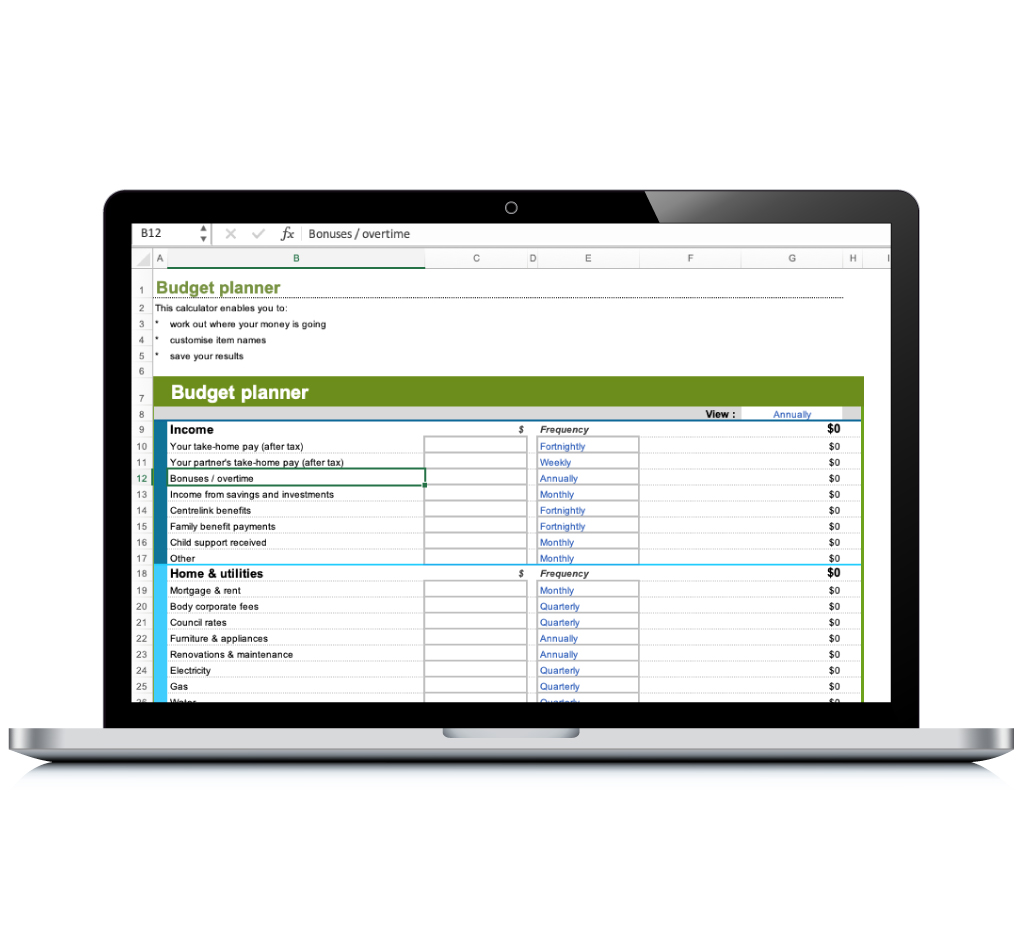

Stripped down to its simplest definition, budgeting is a process we take our clients through initially to understand the income and expenditure of their household income and determine their cash flow position. Without a clear understanding of your cash flow position and spending habits, it’s difficult to be sure of your financial progression and whether the strategies you’re implementing are appropriate or even feasible.

When giving cash flow guidance, our role is to provide our clients with an automated, easy-to-follow system to manage their money and track their spending. We’ll have in-depth discussions around your goals to discover your focus over the short, medium, and long term and subsequently provide recommendations on how to best utilise your surplus cash flow towards achieving these objectives.

What our clients say

Latest Blogs

Frequently Asked Questions

Find an Inovayt Financial Planner near you

Our team of financial planners take pride in helping our clients reach their goals. We create tailored solutions to match your financial and lifestyle goals by understanding your individual circumstances and objectives.